how to calculate a stock's price

2Locate the stocks closing price for a 2-day period. Simple Return Current Price-Purchase Price Purchase Price.

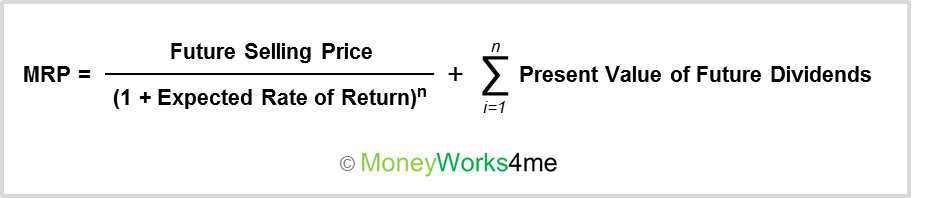

What Is The Right Price Of A Stock How Do You Asses Its Intrinsic Value Moneyworks4me

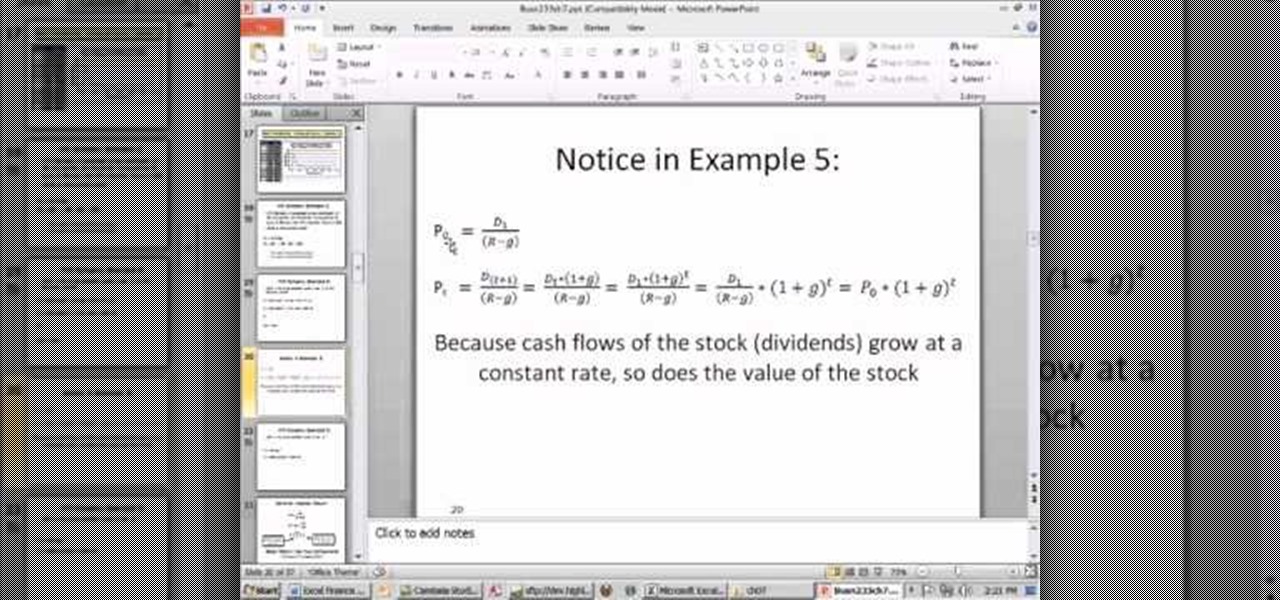

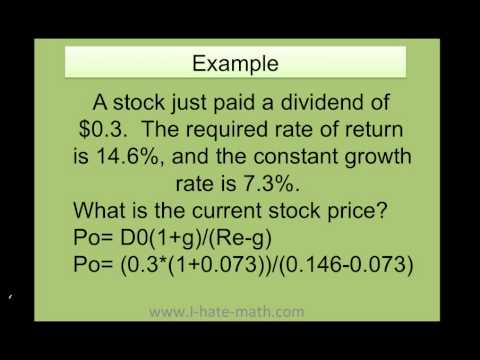

The equation that the Gordon Growth.

. In other words we can stay that the Stock Price is calculated as Lets. Just follow the 5 easy steps below. We can calculate the stock price by simply dividing the market cap by the number of shares outstanding.

Consider the actual performance of the stock over a period as though you had invested in it on that first day of the period. Heres an example using the SP 500 Index. Get Stock Prices Utilizing Built-in Stocks Command 3.

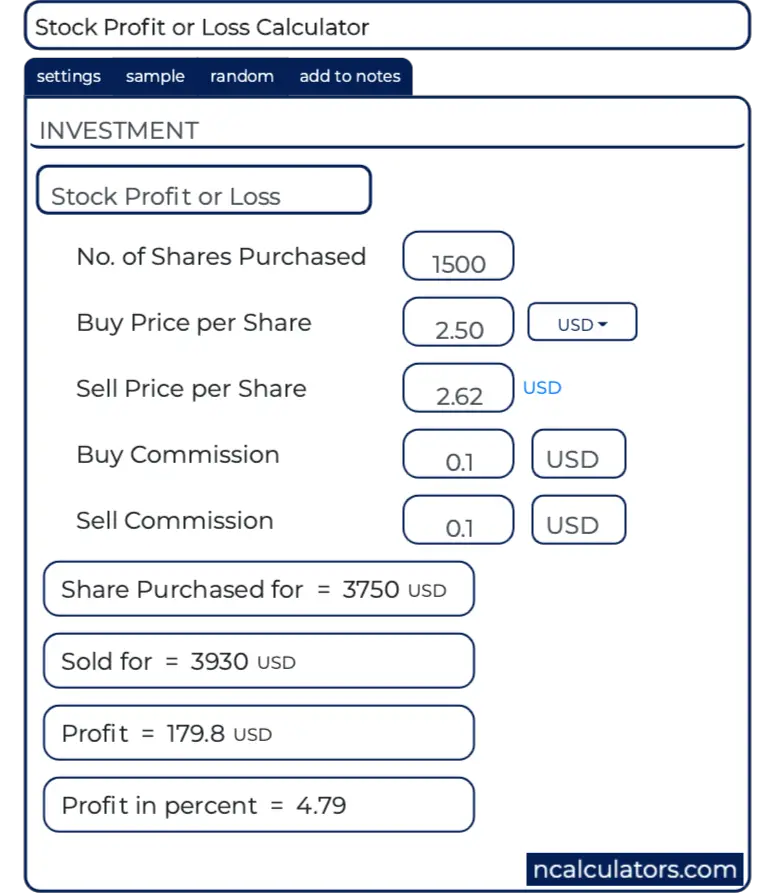

Enter the purchase price per share the selling price per share. Divide the total amount invested by the total shares bought. You can also figure out the average purchase price for.

Additionally look at how the stock has done year to. Sum the amount invested and shares bought columns. Then locate the closing prices of the previous 2 days or a 2-day period in the past if.

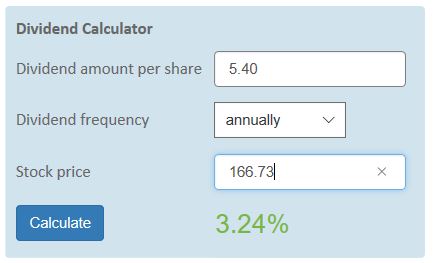

One formula used to value dividend stocks is the Gordon constant growth model which assumes that a stocks dividend will continue to grow at a constant rate. To calculate daily price variation as a percentage divide the variation amount by the closing price of the stock. The Stock Calculator is very simple to use.

Combining STOCKHISTORY and TODAY Functions in Excel 2. Its easy to use and the data is readily. The most popular method used to estimate the internal value of a stock is the average price of a wage.

Now that you have your simple return annualize it. Stock Price Earnings and Shareholders Stock prices are first determined by a companys initial public offering IPO when it first puts its shares into the market. 3 Easy Ways to Get Stock Prices in Excel 1.

To calculate a stocks market cap you must first calculate the stocks market price. Enter the number of shares purchased. Lets say the index was at 4500 when you bought shares of a related index fund and at 4650 when you sold your shares.

For example if you own three shares in the Stock Basis Calculator app and. Calculate your simple return percentage. For example if a stock opened at 75 per share fell to 70 and remained there.

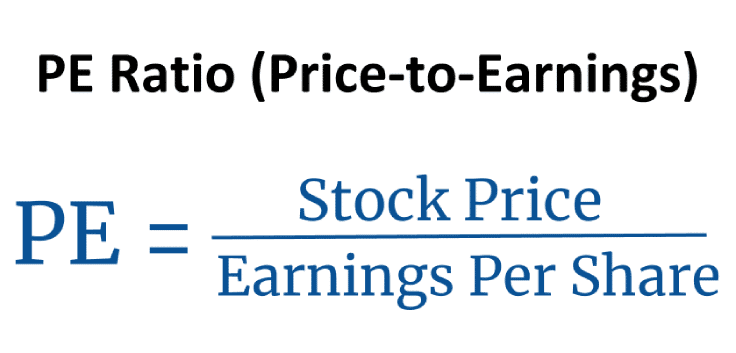

Find the Value of the PE Rasio Ratio. Find the closing prices in the data. The present value of stock is equal to dividend per share divided by the discount rate from which the growth rate has been subtracted.

Take the most recent updated value of the firm stock and multiply it by the number of. To calculate the cost of multiple shares purchased simply add the individual cost basis for each share you own.

How To Calculate Weighted Average Price Per Share Fox Business

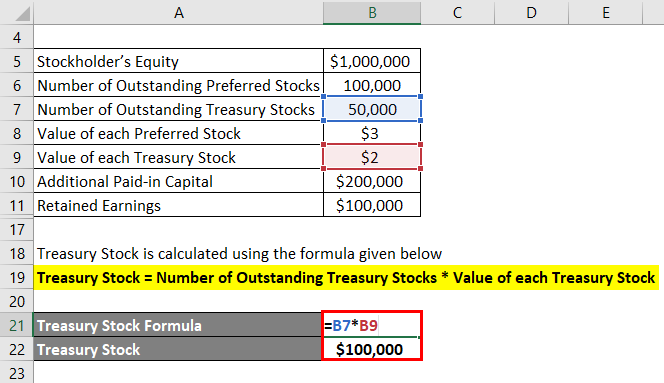

Common Stock Formula Calculator Examples With Excel Template

How To Find The Current Stock Price Youtube

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

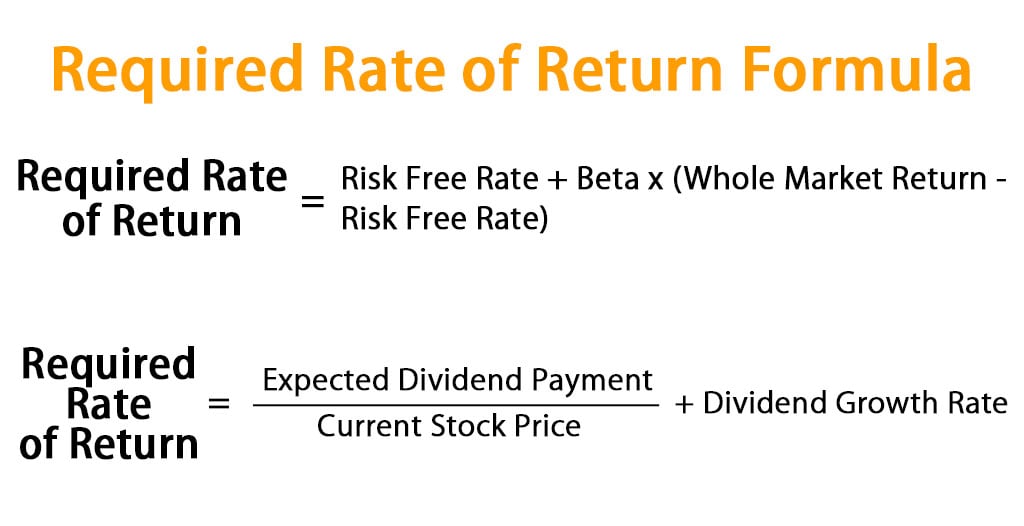

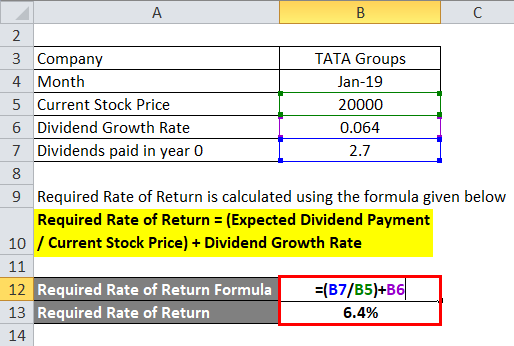

Required Rate Of Return Formula Calculator Excel Template

Common Stock Formula Calculator Examples With Excel Template

Required Rate Of Return Formula Calculator Excel Template

Stock Valuation Chapter 9 1 9 2 Outline Investing In Stocks Capital Gains Dividend Yield Return The Constant Dividend Growth Model The Dividend And Ppt Download

How To Calculate Stock Price From Eps

How To Calculate The Intrinsic Value Of A Stock The Motley Fool

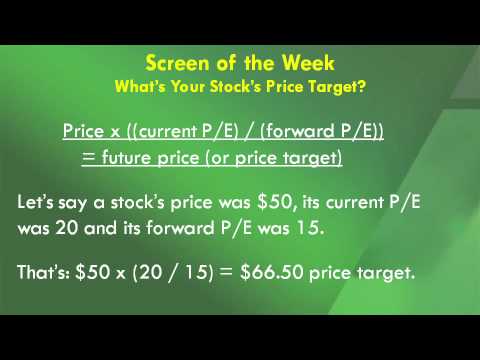

What S Your Stock S Price Target Youtube

Stock Profit Or Loss Calculator

Common Stock Formula Calculator Examples With Excel Template

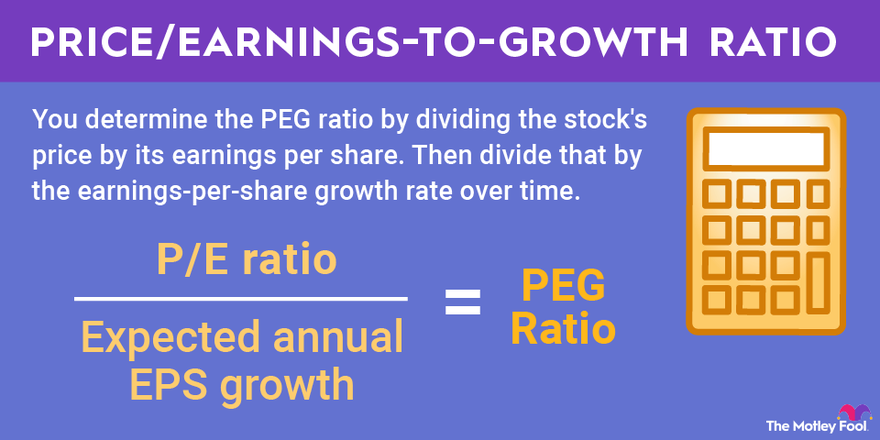

What Is The Peg Ratio The Motley Fool

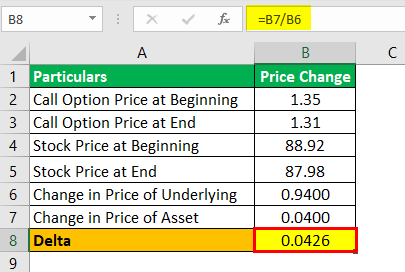

Delta Formula Definition Example Step By Step Guide To Calculate Delta

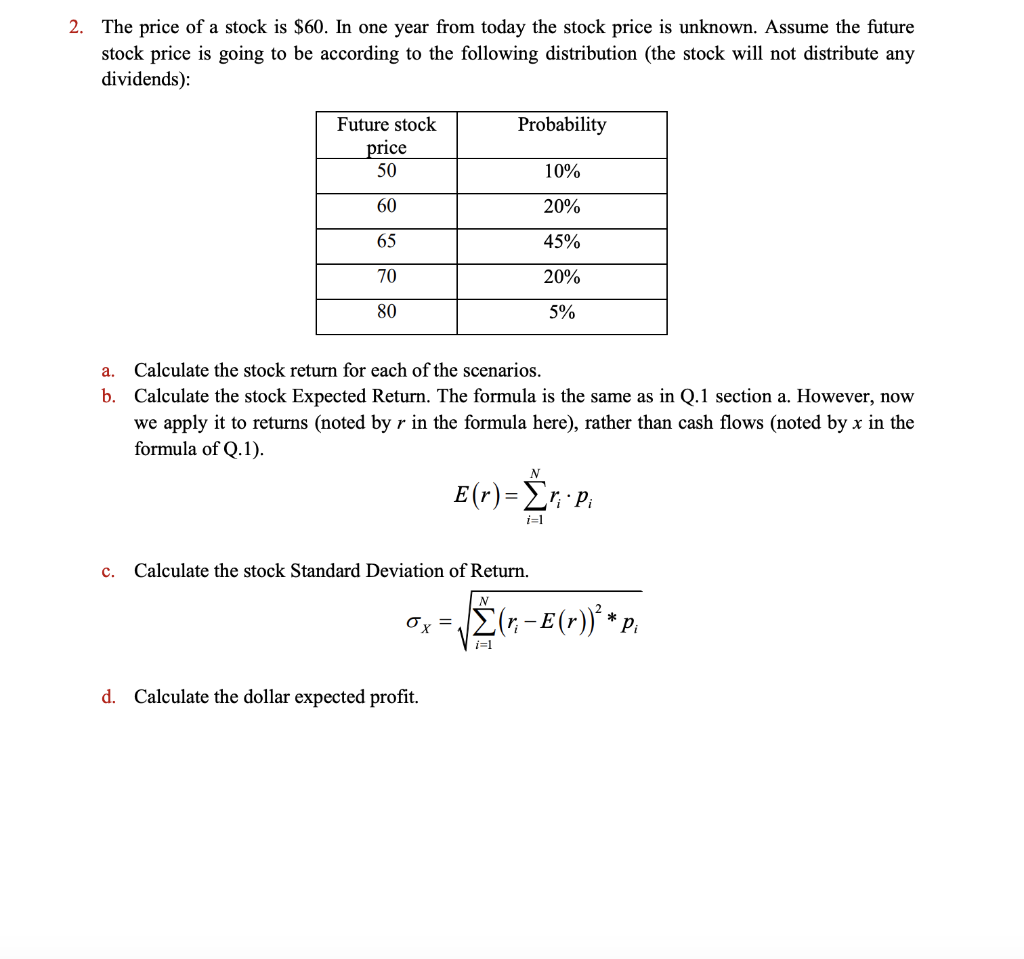

Solved 2 The Price Of A Stock Is 60 In One Year From Chegg Com

How To Predict If A Stock Will Go Up Or Down Beginners Guide Getmoneyrich